Comprehensive Comparison: ORCL, NOW, PANW, CRWD, and ZS

Oracle Corporation (ORCL), ServiceNow (NOW), Palo Alto Networks (PANW), CrowdStrike (CRWD), and Zscaler (ZS). Each company operates at the intersection of secular growth trends—cloud adoption, digital transformation, and AI-driven security—but with distinct business models, competitive positioning, and financial profiles that create materially different risk-return profiles for investors.

Oracle represents the legacy-to-cloud transition story, leveraging its database dominance to capture AI infrastructure demand with massive contracted backlog growth. ServiceNow exemplifies the platform-as-a-service model, embedding AI agents across enterprise workflows to become mission-critical connective tissue. The three cybersecurity providers—PANW, CRWD, and ZS—compete across overlapping but differentiated segments: network and cloud security (PANW), endpoint protection (CRWD), and zero-trust architecture (ZS).

The competitive landscape reveals contrasting trajectories. Oracle trades growth predictability against capital intensity as it pursues GPU-as-a-Service dominance. ServiceNow balances premium valuation with decelerating but still-robust growth as AI monetization accelerates. Among cybersecurity names, CrowdStrike demonstrates the strongest growth acceleration post-incident recovery, while Palo Alto’s platformization strategy faces execution headwinds, and Zscaler capitalizes on zero-trust migration with improving profitability.

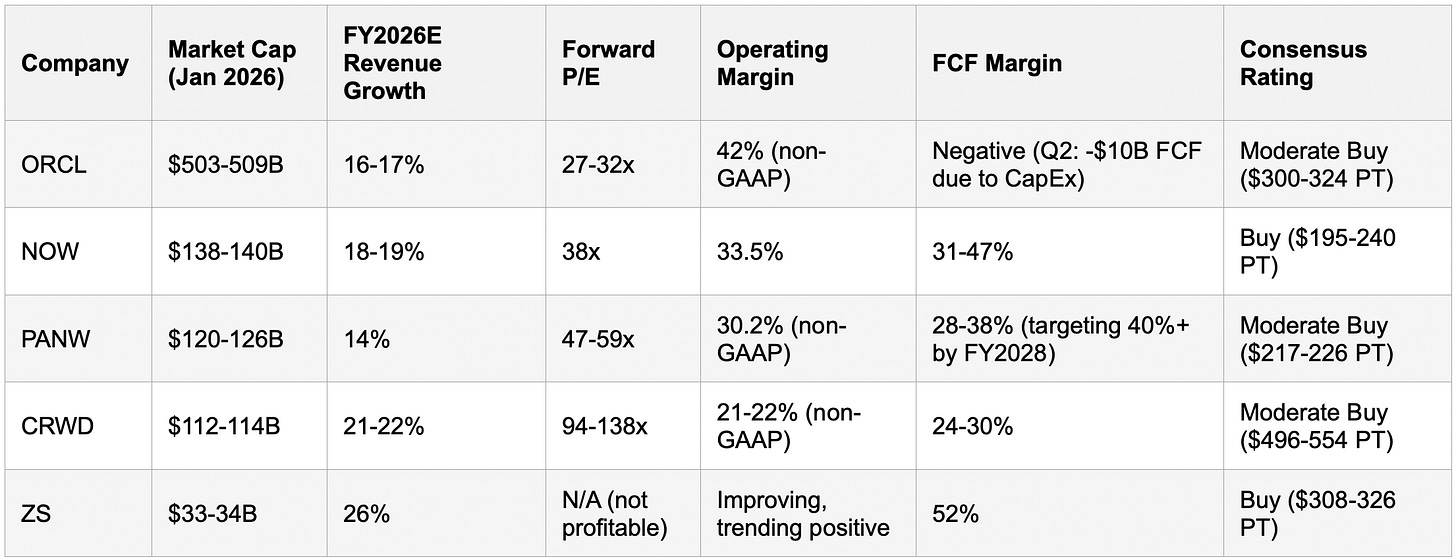

Valuation dispersion is striking: Oracle commands the lowest forward P/E at 27x despite 16-17% revenue growth guidance, ServiceNow trades at 38x supporting 18-19% growth, while cybersecurity multiples range from PANW’s 47x (14% growth) to CRWD’s 94-138x (21-22% growth) and ZS’s negative earnings but 52% free cash flow margin. This pricing reflects divergent market expectations around margin expansion, capital efficiency, and TAM penetration rates.

Business Model and Strategic Positioning Analysis

Oracle (ORCL): Database Incumbency Meets AI Infrastructure Ambition

Oracle’s strategic pivot centers on weaponizing its four-decade database dominance as differentiation in the AI era. The company generated $16.1 billion in Q2 FY2026 revenue (+14% YoY), with cloud revenue reaching $8 billion (+34% YoY) and now representing half of total revenue. Cloud infrastructure revenue surged 66% to $4.1 billion, with GPU-related revenue exploding 177%.

The core business architecture rests on three segments: Cloud and License (which includes Oracle Cloud Infrastructure and Fusion/NetSuite SaaS applications), Hardware, and Services. Oracle’s competitive moat derives from owning the world’s most critical enterprise data—financial services, telecommunications, defense, and intelligence sectors overwhelmingly run on Oracle databases. This “data gravity” allows Oracle to activate AI capabilities on data it already safeguards, avoiding the friction competitors face in convincing customers to migrate sensitive workloads.

Management’s aggressive AI bet manifests through unprecedented capital deployment. Q2 FY2026 saw CapEx balloon to $12 billion, resulting in negative free cash flow of approximately -$10 billion as Oracle builds out massive GPU clusters and data centers. Full-year FY2026 CapEx guidance reached $50 billion, supporting contracts with Meta, NVIDIA, OpenAI (Stargate project contributing 4.5GW of data center capacity), and other hyperscale AI customers.

The contractual foundation appears robust: Remaining Performance Obligations (RPO) exploded 438% YoY to $523 billion—exceeding Denmark’s GDP—with $68 billion added in Q2 alone. RPO expected to be recognized within 12 months grew 40% YoY. This backlog visibility provides revenue predictability but raises critical questions around capital efficiency and margin trajectory as Oracle transitions from high-margin software licensing to capital-intensive cloud infrastructure.

Oracle’s differentiation in AI infrastructure emphasizes superior economics and performance through its Gen 2 cloud architecture, featuring bare-metal compute, ultra-low-latency RDMA networking (perfected over 15 years in Exadata systems), and globally consistent pricing. The company claims its AI clusters run faster and more economically than hyperscaler alternatives, though the negative free cash flow profile pressures near-term earnings delivery.

ServiceNow (NOW): The AI Workflow Operating System

ServiceNow operates as the connective tissue for enterprise digital operations, with its Now Platform processing over 4 billion workflow transactions daily across IT service management (ITSM), HR, customer service, security operations, and cross-departmental automation. The company achieved $3.41 billion in Q3 2025 revenue (+21.8% YoY), with subscription revenue representing approximately 97% of total revenue.

The business model’s structural advantages include high switching costs (workflows deeply embedded in enterprise processes make migration extraordinarily expensive), strong gross margins (78.1% over the last year), and impressive free cash flow generation (31.4% FCF margin). ServiceNow’s platform serves as a single data model and unified architecture that simplifies process automation across disparate enterprise systems, creating powerful lock-in effects.

Management projects subscription revenue will exceed $15 billion in 2026, with AI products (Now Assist) on track to surpass $1 billion in annual contract value (ACV) by year-end 2026, accelerating from $500 million in 2025. The company closed 12 AI deals over $1 million in Q3 2025, including one exceeding $10 million, demonstrating enterprise willingness to pay for AI-driven productivity gains.

ServiceNow’s competitive positioning emphasizes three structural moats: First, deep integration capabilities allow the platform to orchestrate workflows across legacy CRM, ERP, and departmental systems without requiring rip-and-replace migrations. Second, network effects emerge through a robust partner ecosystem (Accenture, Deloitte, Capgemini, TCS, IBM) that enhances platform value as adoption grows. Third, proprietary data advantages—visibility across the IT backbone enables AI/ML models to identify inefficiencies and automate manual processes more effectively than point solutions.

The 2024 acquisition of Moveworks ($2.6 billion) strengthens ServiceNow’s agentic AI capabilities by adding conversational AI reasoning that translates vague human intent into structured workflow actions. This positions ServiceNow not as a workflow vendor with AI features, but as an AI operating system that autonomously triggers enterprise workflows across departments without breaking trust models—a competitive moat difficult for rivals to replicate.

However, risks include decelerating growth (from 32% multi-year CAGR to projected 18-19% in 2026) and premium valuation vulnerability. The company must demonstrate that AI monetization can offset natural SaaS maturation curves as TAM penetration increases.

Palo Alto Networks (PANW): Platformization Strategy Under Execution Pressure

Palo Alto Networks pioneered next-generation firewalls and has expanded into a comprehensive security platform spanning three pillars: Network Security (Strata), Cloud Security (Prisma Cloud), and Security Operations (Cortex). The company delivered $2.47 billion in Q1 FY2026 revenue (+16% YoY), with Next-Generation Security (NGS) Annual Recurring Revenue (ARR) reaching $5.85 billion (+29% YoY).

PANW’s strategic differentiation lies in its platformization approach—encouraging customers to consolidate multiple point security products onto integrated Palo Alto platforms. In Q4 FY2025, the number of customers generating over $20 million in NGS ARR increased nearly 80% YoY, while customers exceeding $5 million and $10 million ARR each grew approximately 50%. These metrics indicate successful upselling among large enterprises seeking unified security architectures.

The business model emphasizes recurring subscription revenue (representing the majority of total revenue) with hardware sales providing initial customer acquisition. PANW sells through a two-tier channel model—primarily via distributors and channel partners rather than direct sales—reaching enterprises across finance, healthcare, government, education, and telecommunications.

Product portfolio depth spans 23 leadership positions across cybersecurity categories according to Gartner, including nine in network security, eight in cloud security, and six in security operations. Key growth drivers include Secure Access Service Edge (SASE) adoption (one-third of Fortune 500 companies as customers), Prisma Cloud for multi-cloud security, and Cortex XSIAM for AI-driven security operations.

Despite these strengths, PANW faces execution challenges. Management guides for 14% revenue growth in FY2026, marking continued deceleration from historical 20%+ growth rates. The company also faces intense competition from CrowdStrike in endpoint security and from cloud-native specialists like Zscaler in SASE, pressuring market share in high-growth segments.

Financial performance shows solid but not exceptional profitability: 73.5% gross margin, 13.2% operating margin over the last year, and 28.3% free cash flow margin. Management targets 40%+ adjusted free cash flow margins by FY2028, up from 38% in FY2025, suggesting confidence in operating leverage despite two pending acquisitions.

CrowdStrike (CRWD): Endpoint Security Leader Demonstrating Post-Incident Resilience

CrowdStrike’s cloud-native Falcon platform represents a paradigm shift from traditional antivirus software, offering lightweight, rapidly deployable endpoint protection with proactive threat intelligence. Q3 FY2026 results showcased strong recovery momentum: $1.23 billion revenue (+22% YoY), ARR reaching $4.92 billion (+23% YoY), and record net new ARR of $265 million (+73% YoY).

The business model centers on the “Land and Expand” strategy—acquiring customers with core endpoint protection, then cross-selling additional Falcon modules (identity protection, cloud security, next-gen SIEM, data protection). Module adoption demonstrates impressive depth: 49% of customers run six or more modules, 34% use seven or more, and 24% employ eight or more as of October 31, 2025.

CrowdStrike’s competitive advantages include industry-leading threat intelligence (analyzing over 3.1 billion AI-driven security transactions monthly), elite subscription gross margins (81%), and the Falcon Flex consumption model that secured $1.35 billion in ARR (+200% YoY). Falcon Flex allows instant module additions without new contract negotiations, reducing procurement friction and accelerating expansion revenue.

The July 19, 2024 Falcon sensor incident—which caused global system disruptions—represented a major reputational and financial test. CrowdStrike absorbed approximately $53 million in incident-related costs in Q3 alone, with GAAP net loss of $34 million including $26.2 million of incident-related expenses. However, business metrics suggest resilient customer loyalty: management now expects at least 50% YoY net new ARR growth in H2 FY2026, upgraded from prior 40% assumptions, and at least 20% net new ARR growth in FY2027.

Financial profile demonstrates strong cash generation despite GAAP losses: Q3 FY2026 operating cash flow reached a record $398 million, with free cash flow of $296 million (24% margin). Non-GAAP operating income hit a record $265 million (21% margin), marking the second consecutive quarter of record operating profitability.

The addressable market remains expansive—management and external estimates converge around $140 billion for calendar 2026, rising to approximately $300 billion by 2030 as endpoint, cloud, identity, data, and AI security converge into integrated platforms. CrowdStrike’s growth acceleration in this TAM positions it favorably, though premium valuation (94-138x forward P/E) demands flawless execution.

Zscaler (ZS): Zero Trust Architecture Pioneer with Accelerating Growth

Zscaler pioneered cloud-delivered Zero Trust Exchange architecture, processing 500 billion AI transactions across 11 months in 2025—a paradigm shift from traditional perimeter-based security. Q1 FY2026 results demonstrated strong momentum: $788 million revenue (+26% YoY), ARR exceeding $3.2 billion (+26% YoY), and RPO of $5.9 billion (+35% YoY).

The business model emphasizes three strategic growth pillars: Zero Trust Everywhere (450+ enterprises implemented, well beyond FY2026 target of 390), Data Security Everywhere (approximately $450 million ARR, growing faster than company average), and AI Security (surpassing $400 million ARR three quarters ahead of the FY2026 target). This diversification reduces reliance on core Zero Trust Internet Access (ZIA) and Zero Trust Private Access (ZPA) products, which comprise approximately $2 billion of the $3.2 billion total ARR.

Zscaler’s competitive differentiation stems from its unified cloud-native platform that eliminates the need for multiple point security products. The architecture secures application communication across SaaS, private clouds, and data centers while ensuring compliance—particularly attractive to enterprises seeking to simplify security infrastructure and reduce Total Cost of Ownership (TCO).

Geographic diversification provides resilience: Q1 FY2026 revenue distributed 55% Americas, 30% EMEA, and 15% Asia-Pacific. Customer concentration among Fortune 500 companies remains relatively low at approximately 45% penetration, indicating substantial expansion opportunity within the estimated 20,000+ potential enterprise clients globally.

Financial performance shows improving profitability trajectory despite GAAP losses. Q1 FY2026 gross margin reached 79.9% (slightly down from 80% prior year due to new product launches prioritizing market entry over margins). More impressively, free cash flow margin hit 52%, demonstrating what management calls “Rule of 78” performance—combining 26% revenue growth with 52% FCF margin, far exceeding the typical “Rule of 40” SaaS benchmark.

The company operates profitably on a non-GAAP basis, with consensus expecting positive GAAP profitability by 2027-2028 as revenue scale drives operating leverage. Trailing twelve-month net loss narrowed to $41 million from higher prior-year losses, indicating margin expansion as growth compounds.

Financial Performance and Profitability Analysis

Revenue Growth and Outlook

Oracle guides for approximately 16-17% revenue growth in FY2026, targeting at least $67 billion total revenue with cloud infrastructure specifically forecast to reach $18 billion for the year. This represents acceleration from historical single-digit growth rates, driven entirely by cloud adoption and AI infrastructure demand. Cloud revenue growing 33-34% YoY substantially outpaces legacy software (down 3-5%) and services, creating a favorable revenue mix shift despite near-term margin pressure from capital intensity.

ServiceNow projects 18-19% revenue growth for calendar 2026, with full-year 2025 subscription revenue estimates around $13.2 billion growing to approximately $15.8 billion in 2026. This deceleration from historical 22-25% growth rates reflects natural SaaS maturation as the company approaches $16 billion revenue scale. However, AI monetization provides upside optionality—Now Assist tracking toward $1 billion ACV in 2026 could add meaningful incremental growth beyond base case forecasts.

Palo Alto Networks guides for 14% revenue growth in FY2026, with NGS ARR expected to grow 26-27%. The divergence between total revenue growth (14%) and NGS ARR growth (26-27%) reflects PANW’s strategic shift from hardware to recurring subscription revenue. Total revenue for FY2026 estimated at $10.42 billion represents 13% YoY growth, below the company’s historical 18-20% range, indicating market maturation and competitive intensity.

CrowdStrike projects 21-22% revenue growth for full FY2026, with total revenue guidance of $4.797-4.807 billion. This acceleration from Q2’s 20% trough demonstrates recovery momentum post-July 2024 incident. More significantly, net new ARR growth accelerated to 73% YoY in Q3, with management expecting at least 50% growth in H2 FY2026—well above prior 40% assumptions. Consensus revenue for FY2027 of approximately $5.87 billion implies sustained 22% YoY growth, supporting the thesis that the Falcon platform is gaining rather than losing market share.

Zscaler guides for 26% revenue growth in FY2026, maintaining impressive velocity at $3+ billion revenue scale. The company raised full-year guidance after exceeding Q1 expectations, with organic growth reaching 22% (above internal projections) and total growth including inorganic contributions at 26%. Management’s three growth pillars—Zero Trust Everywhere, Data Security Everywhere, and AI Security—each exceed original FY2026 targets three quarters ahead of schedule, providing confidence in sustained high-20s growth rates.

Profitability and Margin Structure

Oracle’s margin profile reflects the tension between high-margin software legacy and capital-intensive cloud infrastructure buildout. Q2 FY2026 non-GAAP operating income reached $6.7 billion (41.6% operating margin), up 10% YoY, while GAAP operating income was $4.7 billion (29.2% margin). However, the more critical metric—free cash flow—turned deeply negative at approximately -$10 billion in Q2 due to $12 billion CapEx. Trailing twelve-month operating cash flow was $22.3 billion (+10% YoY), but the CapEx surge to $50 billion annually transforms Oracle from cash cow to cash consumer in the near term.

This capital intensity creates short-term EPS pressure. Q2 non-GAAP EPS of $2.26 beat expectations by 37.8% due to a $2.7 billion one-time gain from selling Ampere chip interest, but the sustainable EPS trajectory faces headwinds from GPU-as-a-Service infrastructure costs. The strategic question: Can Oracle convert massive RPO backlog into profitable cloud revenue fast enough to justify $50 billion annual CapEx and elevated leverage (debt-to-equity of 4.4x)?

ServiceNow demonstrates best-in-class SaaS economics: 78.1% gross margin, 33.5% non-GAAP operating margin (Q3 2025), and 31-47% free cash flow margin depending on the quarter. The company’s asset-light model and pricing power enable simultaneous growth investment and margin expansion. Operating margin improved 1.8 percentage points over the past two years through operating leverage. Analysts project free cash flow margin expanding from current 31% (TTM) to over 40% as AI products scale and the company achieves greater efficiency in customer acquisition.

Palo Alto Networks reports 73.5% gross margin, 30.2% non-GAAP operating margin (Q1 FY2026, up 140 bps YoY), and 28-38% free cash flow margin. Management targets 40%+ adjusted FCF margin by FY2028, indicating confidence in platform consolidation driving efficiency gains despite two pending acquisitions. The company’s pivot to platformization should theoretically expand margins as software mix increases and customer lifetime value grows through module cross-sells, but near-term execution challenges create uncertainty around this trajectory.

CrowdStrike’s profitability profile shows strong cash generation despite GAAP losses. Subscription gross margin reached 81% (non-GAAP) in Q3 FY2026, with total gross margin at 78%. Non-GAAP operating margin approximates 21-22%, solid for a high-growth SaaS business, with operating income reaching a record $265 million in Q3. Most impressively, free cash flow margin hit 24% in Q3 and analysts expect expansion to 30.4% over the next year as the business scales. The divergence between negative GAAP operating margin (-5.6% in Q3) and robust FCF margin (24%) stems from stock-based compensation, which represents approximately 68% of operating cash flow—a non-cash expense that nonetheless dilutes shareholders over time.

Zscaler operates with 79.9% gross margin (Q1 FY2026, slightly down from 80% prior quarter due to new product mix), negative GAAP operating and net margins, but exceptional 52% free cash flow margin. This “Rule of 78” performance (26% revenue growth + 52% FCF margin = 78, far exceeding Rule of 40 benchmark) demonstrates Zscaler’s ability to convert revenue growth into cash despite GAAP losses. Operating expenses grew 23% YoY to $458 million, reflecting continued investment in sales capacity and product development, but the trajectory points toward GAAP profitability by 2027-2028 as revenue scale drives leverage.

Valuation and Market Positioning

Current Valuation Metrics

Oracle trades at 27-32x forward P/E (depending on source), the lowest multiple in this peer set, with forward P/S around 7.44x. This discount reflects market skepticism about capital intensity, margin compression from cloud infrastructure buildout, and execution risk around converting RPO backlog into profitable revenue. The stock declined approximately 26% over six months through January 2026, pricing in concerns about GPU-as-a-Service economics and $50 billion annual CapEx pushing EPS below targets.

ServiceNow commands 38x forward P/E and 10.18x forward P/S, premium valuations justified by best-in-class margins, strong FCF generation, and AI monetization potential. However, the stock fell 31% over the preceding 12 months (through January 2026) as investors recalibrated growth expectations from historical 25%+ to projected 18-19% and questioned whether AI upsells can offset SaaS maturation. The de-rating from 80x+ P/E in prior years to current 38x reflects this growth deceleration, though bulls argue the valuation now offers attractive entry given the company’s mission-critical status and expanding TAM.

Palo Alto Networks trades at 47-59x forward P/E (significant dispersion across sources due to varying EPS assumptions) and approximately 12x forward sales. This represents a premium to Oracle and ServiceNow relative to growth (14% revenue growth supporting ~50x P/E), indicating market confidence in platformization strategy despite near-term execution challenges. The stock gained 20.8% year-to-date through certain measurement periods but remained volatile, reflecting mixed investor sentiment around competitive positioning versus CrowdStrike and Zscaler in high-growth segments.

CrowdStrike trades at 94-138x forward P/E (wide range due to rapidly changing EPS estimates and non-GAAP vs GAAP differences), by far the highest multiple in this peer set. The valuation reflects market conviction that CrowdStrike will sustain 20%+ growth, expand margins significantly as the platform scales, and achieve dominant market share in consolidated endpoint security. However, this multiple offers minimal room for disappointment—any growth deceleration or margin pressure would likely trigger significant multiple compression. The stock declined 9.6% over 30 days through late January 2026 but remained roughly flat year-over-year, indicating consolidation around current valuation levels.

Zscaler remains unprofitable on a GAAP basis, rendering P/E metrics meaningless, but trades at approximately 11-14x forward sales. More relevant metrics include enterprise value to estimated GAAP revenue, which aligns with high-growth SaaS peers, and the FCF yield implied by 52% FCF margin at current revenue. The stock declined 9.3% over 30 days and approximately 6-7% over 12 months through January 2026, reflecting profit-taking after strong FY2025 performance. The valuation appears reasonable relative to 26% revenue growth and improving profitability trajectory, particularly when compared to CrowdStrike’s far more aggressive multiple on comparable growth.

Analyst Consensus and Price Targets

Oracle has consensus “Moderate Buy” rating from approximately 26-41 analysts (sources vary), with average price target ranging $300-324—representing 14-20% upside from January 2026 levels around $178-223. The highest target reaches $400 (Guggenheim, William Blair DiFucci “best idea for 2026”), while the lowest sits at $130-195, creating substantial dispersion that reflects debate about AI infrastructure economics. Morgan Stanley recently cut its target from $320 to $213, citing concerns about GPU-as-a-Service pushing EPS below targets despite sizable revenue opportunity.

ServiceNow carries consensus “Buy” to “Moderate Buy” from 32+ analysts, with average price target $195-240 depending on source and timing. Multiple analysts lowered targets in January 2026 (Wells Fargo from $255 to $225, RBC from $240 to $195, Cantor Fitzgerald to $240) while maintaining positive ratings, arguing that 2026 could be pivotal for enterprise AI adoption. The 12-24% implied upside from current $133-142 levels suggests analysts see the recent 31% decline as overdone relative to fundamentals.

Palo Alto Networks has consensus “Moderate Buy” to “Buy” from 34-49 analysts, with average price target $217-226—roughly 15-20% above January 2026 levels around $180-186. Analyst commentary emphasizes the company’s leadership in 23 cybersecurity categories and platformization potential but acknowledges near-term headwinds from slowing revenue growth and competitive intensity. Price target dispersion appears tighter than Oracle or ServiceNow, indicating greater consensus around fair value.

CrowdStrike shows consensus “Moderate Buy” from 39-54 analysts (sources differ on coverage universe), with average price target $496-554—representing 10-25% upside from January 2026 levels around $443-458. The ratings distribution includes 33-41% “Strong Buy” and 28-41% “Buy,” offset by 17-26% “Hold” and 2 “Sell” ratings. Nine analysts specifically maintain “Strong Buy” ratings post-Q3 results, emphasizing recovery momentum and platform expansion potential. The premium valuation creates bifurcated views: bulls see path to $600+ as ARR reaches $10 billion by 2028-2029, while bears question sustainability of 90-138x forward earnings.

Zscaler garners consensus “Buy” from 34-44 analysts, with average price target $308-326—implying approximately 40-50% upside from January 2026 levels around $209-222. The ratings distribution shows 29-32 “Buy” or “Strong Buy” versus 8-15 “Hold” and 1 “Sell,” more bullish than PANW or CRWD relative positioning. Analysts emphasize Rule of 78 performance, early-stage TAM penetration (only 4,400 of 20,000+ potential enterprise customers), and accelerating adoption across all three strategic growth pillars. The significant implied upside suggests analysts view current valuation as attractive relative to growth and improving profitability trajectory.

Market Dynamics and Competitive Landscape

Total Addressable Market Expansion

The enterprise cloud computing services market is valued at approximately $120 billion in 2022, projected to reach $350 billion by 2030 (15% CAGR). Cloud infrastructure specifically—Oracle’s core battleground—saw Q3 2025 revenues of $106.9 billion globally (+28% YoY sequential growth of $7.5 billion), the strongest performance in three years. Public cloud market size is forecast to reach $488.5 billion by 2026 (16% CAGR). This secular shift from on-premises to cloud underpins Oracle’s aggressive AI infrastructure investment thesis.

The digital workflow automation market—ServiceNow’s domain—was valued at $15-21 billion in 2024-2025, projected to reach $40-71 billion by 2030-2031 depending on source (9-24% CAGR). Key drivers include digital transformation initiatives, rising demand for industry-specific automation, and AI/ML technology advancement enabling more sophisticated process orchestration. ServiceNow’s positioning as mission-critical connective tissue across IT, HR, customer service, and operations places it at the center of this multi-decade transition.

The cybersecurity market demonstrates explosive growth driven by escalating threat sophistication. The overall market is projected at 12-15% CAGR from 2026 to 2030, with specific sub-segments growing faster. AI-powered cybersecurity specifically will grow from $24-29 billion in 2023-2025 to $94-167 billion by 2030 (18-24% CAGR), with the most aggressive forecasts reaching $134 billion. CrowdStrike’s management estimates the addressable endpoint, cloud, identity, data, and AI security market at approximately $140 billion for 2026, expanding to $300 billion by 2030. McKinsey research suggests AI is expanding a $2 trillion total addressable market for cybersecurity providers, with non-CISO cyber spending expected to grow at 24% CAGR over the next three years.

Within cybersecurity, zero-trust architecture adoption (Zscaler’s specialty) is accelerating dramatically: AI transaction volumes processed by Zscaler skyrocketed from 521 million in April 2023 to 3.1 billion monthly by January 2024, with over 536 billion analyzed in 11 months of 2025. Investment appetite remains strong: 82% of IT decision-makers planned AI-driven cybersecurity investments within a two-year window, with 48% committing before end of 2023. This urgency stems from 13% of organizations globally reporting breaches involving AI models or applications in the past year, with 60% leading to compromised data.

Competitive Dynamics and Differentiation

Oracle’s competitive positioning in cloud infrastructure leverages differentiation rather than direct scale competition with AWS, Azure, and Google Cloud. The company emphasizes superior economics and performance through Gen 2 cloud architecture (bare-metal compute, ultra-low-latency RDMA networking perfected in Exadata systems), globally consistent pricing, and embedded AI capabilities directly in Oracle databases at no additional licensing cost. This database-centric strategy weaponizes incumbency: Oracle can activate AI on the world’s most critical enterprise data (financial services, telecom, defense) without requiring data migration—a structural advantage unavailable to hyperscaler competitors.

The Stargate partnership with OpenAI and SoftBank positions Oracle as a neutral AI compute provider, hedging against hyperscaler dominance in AI infrastructure. Sovereign AI push (new regions in Saudi Arabia, UAE, Japan, India by 2026) targets regulated markets where AWS/Azure face data residency barriers, creating geographic moats. However, Oracle’s cloud market share remains fractional versus hyperscalers—the company must execute flawlessly on $523 billion RPO conversion while managing unprecedented capital intensity and debt levels.

ServiceNow’s competitive moat combines switching costs (workflows deeply embedded in enterprise processes), network effects (2+ million monthly active users, 500%+ YoY integration growth into Now Platform), and proprietary data advantages (visibility across IT backbone enables superior AI/ML-driven automation). The Moveworks acquisition enhances agentic AI capabilities, positioning ServiceNow as an AI operating system rather than a workflow vendor with AI features—a subtle but critical differentiation that collapses friction and pulls demand directly into monetization engines.

Primary competition comes from legacy enterprise software vendors (SAP, Microsoft with Dynamics) attempting to add workflow automation, and point solution specialists (Atlassian for ITSM, Workday for HR) carving out departmental niches. ServiceNow’s unified platform architecture theoretically provides superior value through cross-departmental integration, but must continuously prove ROI as competitors embed generative AI into their offerings. The risk: if Microsoft, SAP, or others integrate workflow automation deeply enough into existing ERP/productivity suites, does ServiceNow’s standalone platform justify the switching cost and price premium?

Among cybersecurity competitors, Palo Alto Networks, CrowdStrike, and Zscaler demonstrate both collaboration and competition across overlapping segments. PANW’s comprehensive portfolio (network security, cloud security, security operations) positions it as the “platform consolidator” for enterprises seeking unified architectures. However, this breadth creates execution complexity and slower innovation in specific verticals versus specialists.

CrowdStrike dominates endpoint protection with cloud-native Falcon platform, outscoring PANW and Microsoft in Gartner’s Magic Quadrant for endpoint defense. The company’s competitive advantages include superior threat intelligence (processing 3.1 billion+ AI transactions monthly), Falcon Flex consumption model reducing procurement friction, and module depth (49% of customers running 6+ modules) driving 23% ARR growth. Post-July 2024 incident, customer retention exceeded expectations, validating the mission-critical nature of endpoint security and high switching costs.

Zscaler’s zero-trust architecture competes primarily in SASE/secure web gateway markets, where PANW also plays, but with cloud-native purity versus PANW’s hybrid on-premises-to-cloud migration path. Zscaler’s differentiation emphasizes unified cloud platform eliminating multiple point products, 52% FCF margin demonstrating superior unit economics, and early-stage TAM penetration (4,400 of 20,000+ potential enterprise customers) providing long runway. Competition from Cloudflare (rising SASE player) and potential Microsoft bundling (Entra/Azure security services) represent threats, but Zscaler’s specialized architecture and performance advantages maintain differentiation.

The cybersecurity landscape increasingly favors platform consolidation—enterprises prefer fewer vendors with integrated solutions over complex multi-vendor stacks—which benefits all three names but particularly PANW given comprehensive portfolio breadth. However, execution matters: CrowdStrike’s growth acceleration suggests endpoint-first platform expansion resonates more strongly than PANW’s firewall-centric platformization in current market conditions. Zscaler’s specialized zero-trust focus allows superior innovation velocity in that domain versus PANW’s need to balance multiple product lines.

Risk Factors and Investment Considerations

Oracle Risk Profile

Capital Intensity and Leverage: The $50 billion annual CapEx commitment creates significant financial risk. Oracle’s debt-to-equity ratio already stands at 4.4x, and negative free cash flow in recent quarters pressures both balance sheet flexibility and earnings delivery. If AI infrastructure demand softens or hyperscaler competition intensifies pricing pressure, Oracle could face stranded asset risk with underutilized GPU clusters and data centers.

Execution Risk on RPO Conversion: The $523 billion RPO backlog provides visibility but not certainty. Oracle must convert these contracts into profitable revenue while managing customer implementations, maintaining service quality, and defending against competitive raids. Any significant contract delays, cancellations, or renegotiations (particularly from Meta, NVIDIA, or OpenAI) would materially impact growth trajectory and investor confidence.

Margin Compression: Transition from 90%+ gross margin software licensing to capital-intensive cloud infrastructure inherently compresses margins. While management argues cloud margins will improve over time through scale and efficiency, near-term trajectory remains uncertain. The tension between aggressive AI investment and shareholder return expectations creates potential for multiple compression if earnings disappoint.

ServiceNow Risk Profile

Valuation Sensitivity to Growth Deceleration: Trading at 38x forward P/E supporting 18-19% growth, ServiceNow offers limited margin of safety. If AI monetization disappoints, competitive intensity increases, or macroeconomic headwinds pressure enterprise IT spending, the stock could face significant multiple compression. The 31% decline over preceding 12 months demonstrates this sensitivity.

Competitive Threats from Platform Giants: Microsoft’s integration of workflow automation into Microsoft 365, Power Platform, and Dynamics creates bundling risk. If Microsoft offers “good enough” automation embedded in productivity suites that enterprises already pay for, ServiceNow’s premium standalone pricing faces pressure. Similarly, SAP’s embedding of automation in ERP workflows targets the same enterprise budgets.

AI Monetization Uncertainty: While Now Assist tracks toward $1 billion ACV in 2026, the broader question remains: Can AI agents genuinely justify incremental spending, or do they primarily improve efficiency within existing license bases? If AI capabilities are expected as table stakes rather than premium add-ons, ServiceNow’s growth acceleration thesis weakens considerably.

Palo Alto Networks Risk Profile

Platformization Execution Challenges: Revenue growth decelerating to 14% despite 26-27% NGS ARR growth indicates challenges converting platform strategy into consolidated revenue. If enterprise customers adopt PANW modules slowly, preferring point solutions from specialists (CrowdStrike for endpoint, Zscaler for SASE), the platformization thesis unravels.

Competitive Intensity in High-Growth Segments: CrowdStrike’s endpoint dominance and Zscaler’s SASE momentum squeeze PANW in faster-growing cybersecurity verticals. While PANW maintains network security leadership, that segment grows slower than cloud-native endpoint and zero-trust categories. Market share losses in strategic growth areas would pressure valuation despite overall market expansion.

Integration Risk from Acquisitions: PANW’s strategy includes acquiring capabilities (announced intent to acquire Chronosphere for observability), which creates integration execution risk and potential margin dilution. If acquisitions fail to deliver expected synergies or distract management focus, profitability improvements could disappoint relative to FY2028 targets.

CrowdStrike Risk Profile

Premium Valuation Leaves No Room for Error: At 94-138x forward P/E, CrowdStrike trades for perfection. Any growth disappointment, competitive loss, security incident recurrence, or margin pressure would likely trigger severe multiple compression. The July 2024 Falcon sensor outage demonstrated operational risk—while customer loyalty held, a repeat incident would probably cause more significant defections.

Concentration Risk in Endpoint Security: Despite platform expansion into identity, cloud, SIEM, and data protection, CrowdStrike remains predominantly an endpoint security company. If endpoint security itself gets commoditized (e.g., through Microsoft Defender bundling improving sufficiently), or if attackers shift focus to attack surfaces where CRWD is less dominant, growth deceleration could surprise negatively.

Customer Consolidation Pressure: While CrowdStrike benefits from security platform consolidation, it also faces risk from customers consolidating onto competitors’ platforms. If PANW or Microsoft successfully convinces large enterprises to standardize on their comprehensive platforms, CrowdStrike’s specialized positioning could limit TAM penetration despite technological superiority.

Zscaler Risk Profile

Path to Profitability Uncertainty: While FCF margin of 52% appears robust, GAAP profitability remains elusive. If Zscaler requires sustained high sales and marketing spend to maintain 26% growth, GAAP profitability timeline could extend beyond 2027-2028 expectations, pressuring valuation. Investors have limited patience for perpetual losses even with strong cash generation.

Competitive Threats from Cloudflare and Microsoft: Cloudflare’s rapid SASE market entry with bundled offerings creates pricing pressure. Microsoft’s potential to embed zero-trust capabilities deeply into Azure and Entra (identity/access management) represents significant threat given customer willingness to consolidate onto fewer vendors. If “good enough” zero-trust functionality comes bundled with hyperscaler cloud services, Zscaler’s specialized value proposition weakens.

Customer Concentration and Renewal Risk: With only 4,400 enterprise customers generating $3.2 billion ARR, average customer value exceeds $700,000 annually—indicating significant concentration risk. Any material customer losses or downgrades (e.g., due to economic weakness or competitive displacements) would materially impact growth trajectory. Net retention rates remain strong but require continuous monitoring.

Investment Recommendation Summary

Oracle (ORCL) represents a high-risk, high-reward transformation bet suitable for investors with conviction in AI infrastructure demand sustainability and Oracle’s ability to execute massive capital deployment profitably. The stock trades at the lowest valuation multiple (27-32x forward P/E) despite 16-17% guided growth, creating potential value if RPO conversion accelerates and margins stabilize. However, negative free cash flow, elevated leverage, and execution risk warrant caution. Appropriate for growth-oriented portfolios willing to accept 3-5 year holding periods and near-term volatility.

ServiceNow (NOW) offers institutional-quality exposure to digital transformation and AI-driven workflow automation, with best-in-class margins, strong competitive moats, and improving growth visibility. The 31% decline creates potential entry opportunity at 38x forward P/E, assuming AI monetization reaches $1 billion ACV in 2026 as projected. Risks include valuation sensitivity to growth deceleration and competitive threats from Microsoft. Suitable for quality-focused growth investors seeking exposure to mission-critical enterprise software with durable competitive advantages. Position sizing should reflect premium valuation and execution risk.

Palo Alto Networks (PANW) provides comprehensive cybersecurity exposure through market-leading platform breadth, but faces near-term execution challenges reflected in 14% revenue growth guidance. Trading at 47-59x forward P/E, valuation appears full relative to growth, particularly when compared to CrowdStrike’s superior growth profile (21-22%) at comparable or only moderately higher multiples. PANW suits investors prioritizing stability and established market leadership over growth acceleration, with understanding that competitive dynamics create risk to premium valuation. Consider for core cybersecurity allocation but expect modest returns absent re-acceleration.

CrowdStrike (CRWD) demonstrates the strongest growth momentum (21-22% revenue growth accelerating, 73% net new ARR growth in Q3) and operational recovery post-July 2024 incident, validating business resilience and customer loyalty. However, valuation at 94-138x forward P/E embeds aggressive expectations, leaving minimal room for disappointment. Appropriate for growth-aggressive investors willing to pay premium multiples for market-leading positions in high-TAM categories. Risk-adjusted returns likely require sustained execution excellence and margin expansion—not a core holding for risk-averse investors but defensible as satellite position given platform strength and TAM runway.

Zscaler (ZS) offers the most compelling risk-reward profile among cybersecurity names when considering growth (26%), improving profitability trajectory (52% FCF margin), early-stage TAM penetration (4,400 of 20,000+ potential customers), and valuation (11-14x sales with path to GAAP profitability by 2027-2028). The 40-50% analyst upside implies market under-appreciates zero-trust migration secular tailwind and Rule of 78 performance sustainability. Primary risks include competitive intensity from Cloudflare and Microsoft, and execution on GAAP profitability timeline. Suitable for growth portfolios seeking exposure to zero-trust architecture with better valuation than CRWD and superior growth versus PANW.

Relative Ranking for 2026:

Zscaler (ZS) – Best risk-adjusted return potential given growth, valuation, and TAM runway

CrowdStrike (CRWD) – Strongest growth momentum but valuation risk limits margin of safety

ServiceNow (NOW) – Quality compounder with durable moat, recent decline creates opportunity

Oracle (ORCL) – High-risk transformation bet, cheapest valuation but significant execution uncertainty

Palo Alto Networks (PANW) – Market leader but valuation full relative to decelerating growth

Portfolio construction could combine ServiceNow (core quality growth), Zscaler (growth with reasonable valuation), and selective exposure to Oracle or CrowdStrike depending on risk tolerance. PANW appears least attractive on relative basis given valuation-to-growth tradeoff, though remains defensible for investors prioritizing comprehensive cybersecurity platform breadth and established enterprise relationships.

Disclaimer

This report is provided for informational and educational purposes only and does not constitute investment advice, financial advice, trading advice, or any other sort of advice. The information contained herein is based on publicly available data and analysis as of January 26, 2026, and reflects the author’s views and interpretations, which are subject to change without notice.

Nothing in this report should be construed as a recommendation to buy, sell, or hold any security. Investing in stocks involves substantial risk, including the potential loss of principal. Past performance is not indicative of future results. Forward-looking statements, price targets, growth forecasts, and analyst estimates referenced herein are inherently uncertain and may prove materially incorrect.

Readers are strongly encouraged to conduct their own due diligence, consult with qualified financial advisors, and consider their individual financial circumstances, investment objectives, risk tolerance, and time horizon before making any investment decisions. The author assumes no liability for any financial losses or damages resulting from reliance on the information presented in this report.

Market conditions, competitive dynamics, regulatory environments, and company-specific circumstances can change rapidly and materially affect investment outcomes. The technology sector specifically exhibits elevated volatility, rapid innovation cycles, and competitive disruption that create heightened uncertainty around long-term projections.

All data, financial metrics, analyst ratings, and price targets cited in this report are sourced from third-party providers and believed to be accurate as of the publication date, but the author makes no warranties regarding completeness, accuracy, or timeliness. Any errors or omissions are unintentional.

This report does not constitute an offer or solicitation to buy or sell securities in any jurisdiction. Securities discussed may not be suitable for all investors. Diversification and asset allocation strategies do not guarantee profit or protect against loss.